Helping you stay informed about the industry’s most important trends & topics.

Discover Insight Quarterly.

Lockdown is masking new car supply problems caused by the EU exit

The current lockdown has masked the issues on new car supply related to the EU exit deal, with border frictions continuing and many industry leaders indicating there is no easy fix. This has been compounded by a global microchip shortage which continues to hamper an increasing number of manufacturer production lines. The disruption will soon impact new vehicle supply in the global market.

Meanwhile, the new car market continues to struggle after a 39.5% drop in registrations last month and early signs point towards a similar decline in February. As a result, the March new plate has become increasingly crucial for the sector, however 75% of dealers in a recent Cox Automotive survey have indicated that new car orders for March are down year-on-year between 10 and 50%.

Q1 is a critical period and it's vital that showrooms are able to re-open as soon as possible. Still, it's encouraging to see many retailers have quickly adapted to the current conditions and perform well against the odds.

Used cars outperformed expectations in 2020

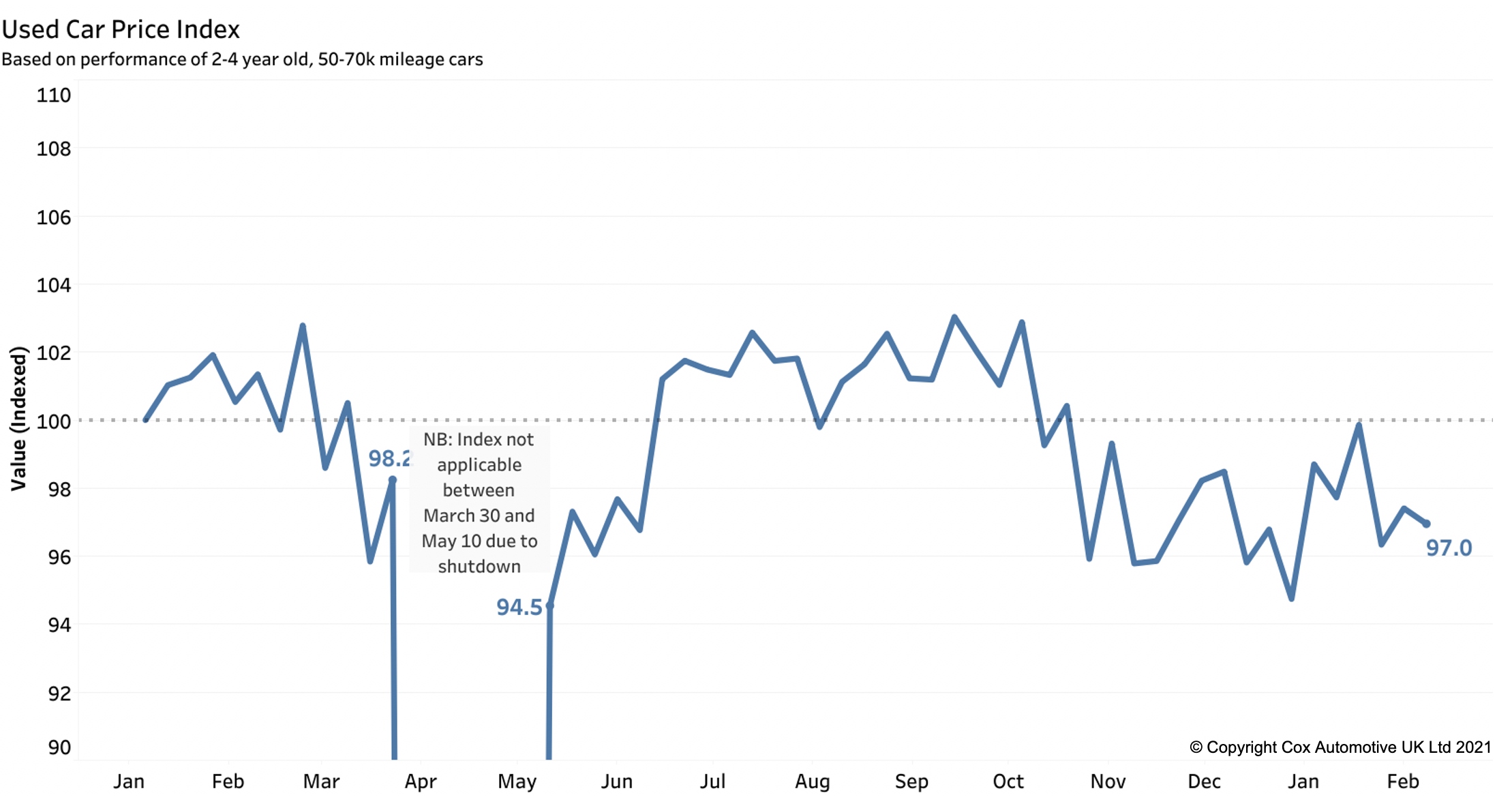

The used car market continues to prove its resilience compared to the new car market. While used car sales fell -14.9% to 6,752,959 in 2020, the sector actually outperformed expectations with a partial recovery towards the end of the year. As reported in the Insight Report 2020, the market was forecast to hit 6.41m used car transactions.

Changing consumer habits saw an increased demand for used cars that continues into this year. With the market already undergoing a shift towards digital retail prior to the pandemic, retailers were able to swing their focus to e-commerce remarkably quickly and capitalise on this demand.

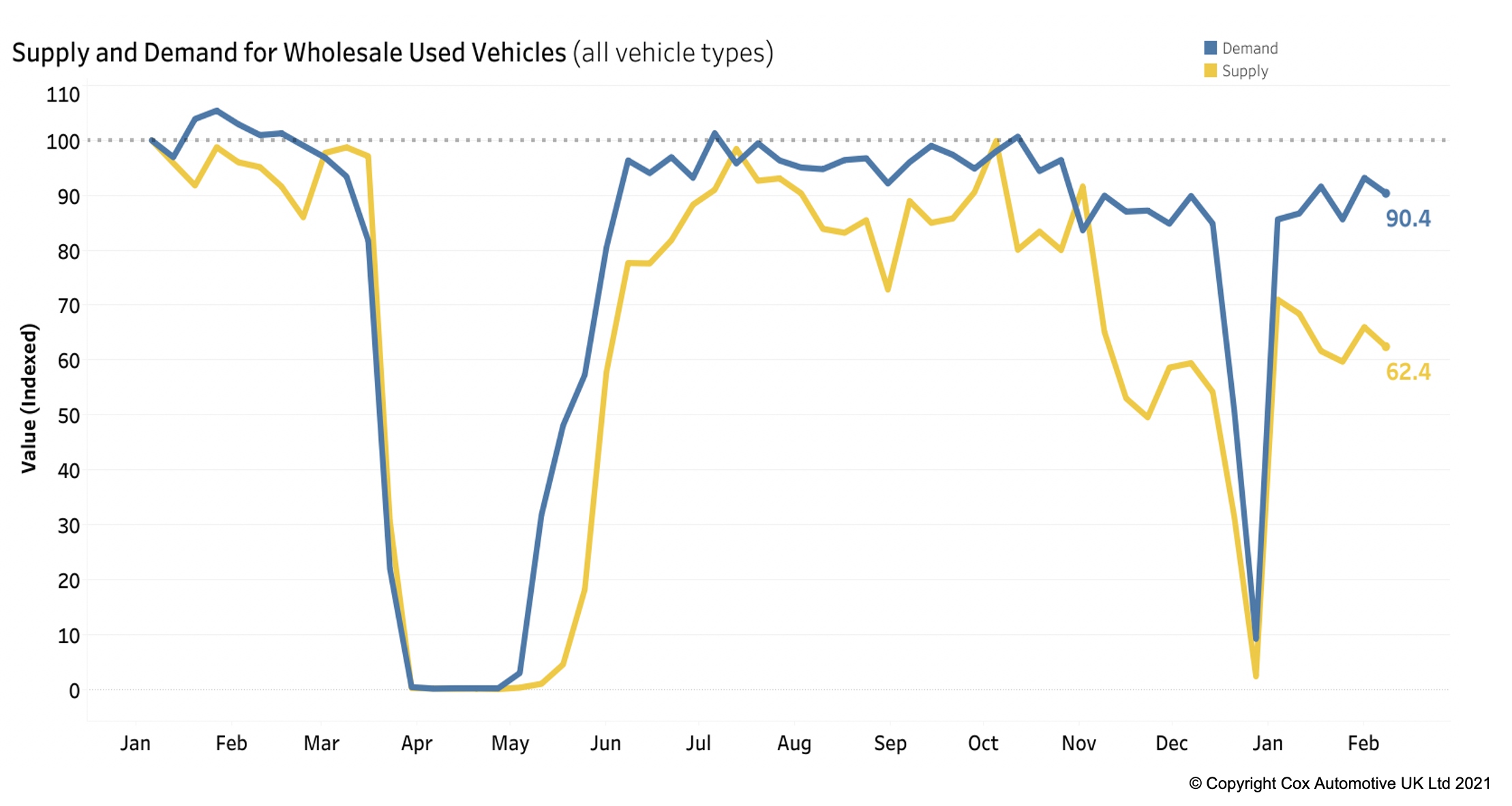

Wholesale supply issues remain but dealer optimism increasing

Supply volumes in the wholesale market remain significantly behind 2020, caused in part by a reduction in the number of part-exchanges entering the wholesale market. Despite this, buyer demand is seeing marginal increases as retailers begin to lift buying bans surrounding optimism that the lifting of restrictions will soon be announced.

As expected, trade values have eased as buyers become increasingly selective about what they buy, with accurately graded and retail-ready vehicles seeing the highest demand. In some cases, retailers are holding back from increasing their stock levels and are focused on only replenishing sold volumes.

Market sentiment indicates that retailers are not anticipating the same sales activity level once the current lockdown eases. While we should see increases, it will not be to the levels observed in Q3 2020 that were bolstered by substantial pent-up demand.

Start your journey

We’re transforming the operations of the world’s leading automotive brands. Get in touch to find out how.